Variable recurring

payments

for sweeping

Boost your recurring revenue with seamless, secure payments. Our API empowers faster, more efficient "me-to-me" transactions.

Explore our API or get in touch to learn more.

What are Variable recurring payments (VRPs)

Variable Recurring Payments (VRPs) are a new type of payment instruction that allow customers to safely connect authorized payments providers to their bank account. This lets those providers make payments on the customer's behalf, within agreed limits.

Think of it as a more flexible and secure way to manage recurring payments. You're essentially giving permission to a third party to take varying amounts of money from your account at regular intervals, but you remain in control by setting the rules.

Key features of Variable Recurring Payments

Variable Amounts

Unlike standing orders where the amount is fixed, VRPs allow for payments of different amounts each time. This is useful for subscriptions where the cost fluctuates, like utility bills or gym memberships

More Control

You have greater control over your payments. You set the limits on how much can be taken and how often, and can easily change or cancel the agreement at any time.

Increased Transparency

You'll receive notifications and updates about upcoming payments, giving you full visibility and peace of mind.

Enhanced Security

VRPs are built on open banking technology, which uses strong customer authentication and secure APIs to protect your data and prevent fraud.

There are two main types of VRPs:

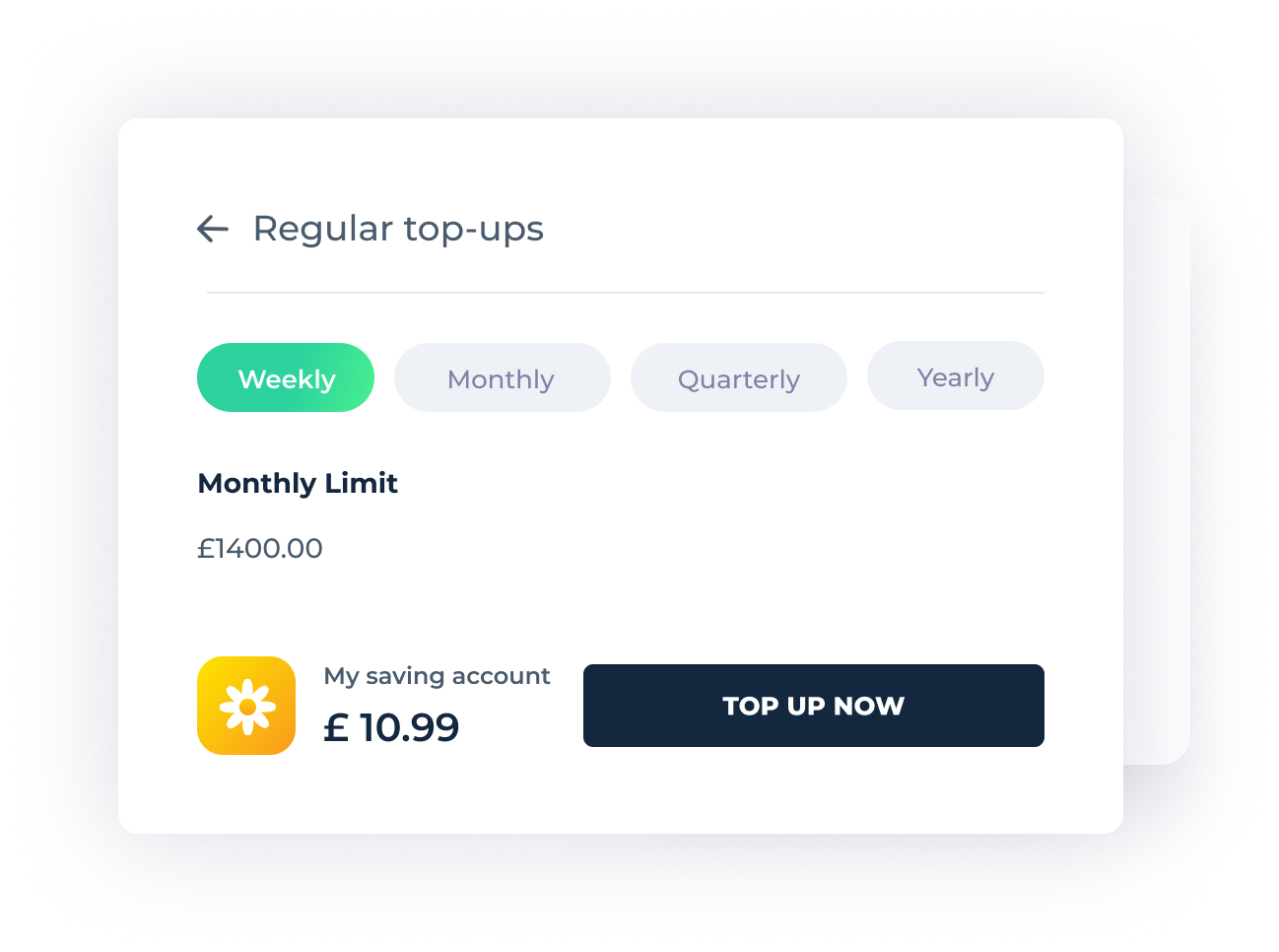

Sweeping VRPs

These are currently available and designed to move money between your own accounts, for example, automatically transferring funds from your current account to a savings account.

Commercial VRPs

These are expected to be rolled out soon and will allow businesses to collect payments for goods and services. This could be a game-changer for subscriptions, recurring bills, and online purchases.

VRPs offer a range of benefits for both consumers and businesses. For consumers, they provide more control, flexibility, and transparency over recurring payments. For businesses, they can reduce costs, improve efficiency, and enhance customer relationships.

Why to try VRPs for sweeping?

Save more and pay less with automated sweeping. This innovative payment technology lets you effortlessly move money between your accounts, maximizing your savings and minimising debt.

Who is it for?

eMoney institutions

Banks

Fintech

Loan and credit firms

Investment platforms

Building societies

[COMING SOON]

Commercial VRPs

VRPs outside of sweeping will be released in 2025

VRPs offer a range of benefits for both consumers and businesses. For consumers, they provide more control, flexibility, and transparency over recurring payments. For businesses, they can reduce costs, improve efficiency, and enhance customer relationships.

Commercial VRPs and its use cases

Direct Debits (alternative)

Subscription payments

Instant one-off payments

Card on file (alternative)

B2B accounts payable

Recurring ad hoc payments

Don’t miss out on this unrivalled opportunity!

JOIN A WAITING LISTCommercial VRPs are coming soon!

If you are interested in, please join the waiting list below

Join the waiting list